Arcadis Contract Solutions released their Global Construction Disputes 2018 Report – Does the Construction Industry Learn from Its Mistakes? The 30-page report highlights key themes and patterns that has been occurring within the global dispute market that can be used to reflect the market trends.

According to Arcadis, in 2016- 2017, the most common cause of disputes was a failure to properly administer contracts, and in 2018 this remains as the number one cause of construction disputes.

With an increase in more complex projects and uncertainty in the market there’s bound to be some oversights and increase in value of each dispute. The report this year is focused on human behaviour and being proactive when it comes to avoiding disputes from the start of the project cycle instead of waiting it out.

“In an environment of labor shortages and increased pressure from expediting projects, it is often instinctual to focus on getting a project started first and dealing with consequences later.” (Arcadis: Global Construction Dispute 2018)

Digital Transformation

The construction industry has been gradually implementing digital technology to help improve productivity and efficiency and this change has generated innovative ways to creating solutions to dealing with ongoing issues.

Arcadis noted that using digital technology pre-and post contract helps to drive not only value but also efficiency of the project. Examples of the technology that are being used are drones, augmented reality to track progress, advanced analytics for bench-marking and producing quality estimates and more.

Integrating innovative technologies can be a powerful tool to solve problems and drive project progress in a positive way. The key areas where the construction industry can benefit from technology are:

• Reduced siloes and improved stakeholder management

• Improved transparency in strategy, communication and controls of programs

• Enhanced ability to curate and manages metrics that support business decisions

• Seamless and easy knowledge management and transfer

• Improved trust and accuracy in estimates

Overall Findings from the Global Construction Disputes 2018 Report

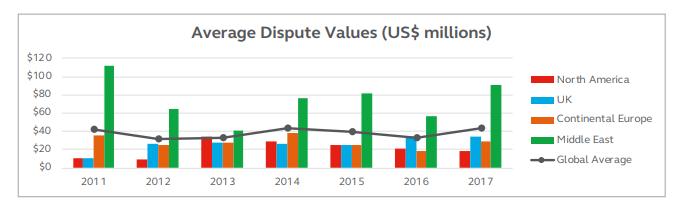

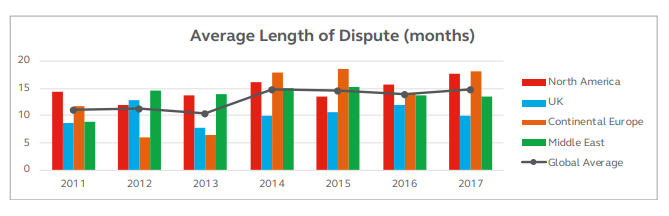

Arcadis researched and documented the global dispute trends in 4 different regions – North America, United Kingdom, Continental Europe and the Middle East over the past 7 years; 2011 to 2017.

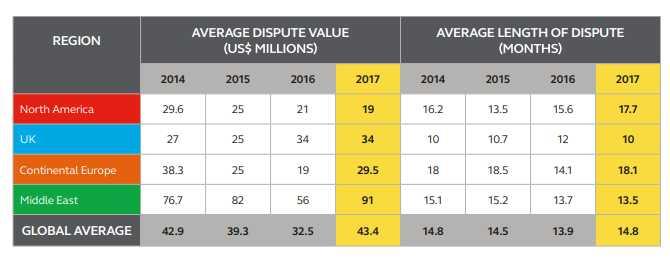

In the chart below are the cost and length of time it took to resolve the global construction dispute based on the geographical regions. Emphasised in this report is the global average value of disputes was US$43.4 million, and these disputes increased slightly to 14.8 months on average, but the volume was the same from 2016.

As you can see in the image above, from 2014 to 2017, the region with the highest average dispute value is still the Middle East with US$46.6 million more than the global average.

Continental Europe remain consistent with taking 18 or 18.5 months to resolve disputes from 2014 to 2015 with a slight decrease in 2016 and a slight increase in 2017 hitting the 18.1 months mark – which is slightly more than the North American region; 17.7.

According to Aracadis, ‘disputes’ are defined as “a situation where two parties typically differ in the assertion of a contractual right, resulting in a decision being given under the contract, which in turn becomes a formal dispute”.

As you can see in the image above over the years, the value was fluctuating by region, but the Middle East took the cake with it came to higher dispute values from 2011 to 2017; with North America remain the lowest with a slight increase over time.

The length of a dispute is also defined by Arcadis as “the period between when it becomes formalized under the contract and the time of settlement, or the conclusion, of the hearing”.

As you can see in the image above over the years, Continental Europe has been consistently increasing over the past 4 years followed closely by North America and Middle East. This increase in time it takes to resolve disputes is usually caused by an increase in construction and building infrastructure. The larger and more complex the project the more disputes and complications it may cause.

Overall, a failure to properly administer the contract is still ranks as the number 1 cause of construction disputes as last year. The cause of this fell onto the employer, subcontractor and contractors failing to comply or understand the contractual obligations. The sectors that were most affected with disputes were the social infrastructure/public sector, followed by the transportation sector.

The most common methods that was used to resolved disputes changed over the years as seen in the image below:

Globally, party-to-party negotiation continued to rank number 1 in 2016 to 2017.

Global Construction Disputes By Region

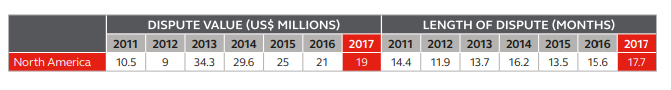

North America

Over the past few years, the value of the disputes that North America had to faced in the construction sector was up and down over the past few years. The cost of disputes went from US$25 million in 2015 to US$21 million in 2016 and slightly dropped to US$19 million in 2017.

This drop makes it the fourth consecutive year that the value of disputes dropped since a peak in 2013.

The average time it took to resolve these disputed over the past few years slightly increased over the years. There was an increase by 2 months from 15.6 months in 2016 to 17.7 months in 2017. These averages surpass the global average of 14.8 months.

The research conducted by Arcadis illustrates that the transportation market is blowing up with new construction in North America, specifically investments in desirable infrastructures and mega projects.

The expectation is that with larger projects there will be larger disputes which will need a practical risk management strategy which in turn can help save the project time and money.

The Number 1 dispute cause in North America is Errors and/or omissions in the contract document which ranked number 1 in 2016. The method to resolve these disputed remains the same – Party-to-party negotiations.

United Kingdom

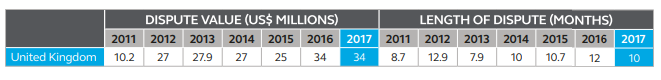

In the UK the average value of construction disputes remained at US $34 million from 2016. This was an increase in 2015 from US$25 million. Over the years, the disputes in the UK fluctuated from being the lowest average globally to be the most expensive on average compared to North America and Europe.

The average time it takes to resolve the disputes in the UK slightly dropped from 2016’s 12 months to 10 months in 2017. This is also slightly lower from 2015’s 10.7 months to resolve disputes.

Compared to other jurisdictions, the UK takes approximately 3.5 months faster than the Middle East to resolved disputes.

The Number 1 dispute cause in the UK is a failure to properly administer the contract which ranked number 1 in 2016 as well. The method to resolve these disputed remains the same – adjudication (Contract or ad hoc).

Continental Europe

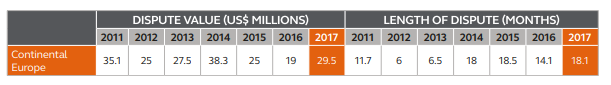

In Continental Europe the average value of disputes increased greatly from US$25 million in 2015 to US$29.5 million in 2017 but it below the average that was quoted in 2014, US$38.3 million. Regardless of the high dispute value of this region, it remains below the global average of US$43.4 million.

The length of disputes increased by 4 months from 2016 to 18.1 months in 2017, dropping back to slightly match the time to resolve disputes in 2014 which was 18 months and in 2015 18.5 months.

An increase in the time it takes to resolve a dispute in this region shows that Continental Europe has a problem resolving disputes in a timely-manner for this to increase in such a substantial amount.

These increases in dispute were caused by Joint Venture (JV), which went from 10.4% of cases in 2016 to 32.5% in 2017.

The Number 1 dispute cause in this region is Employer/Contractor/Subcontractor failing to understand and/or comply with its contractual obligations. This cause rose from the third spot in 2016. The method to resolve these disputed remains the same – Party-to-Party Negotiations.

The Middle East

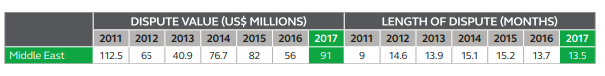

In this region, the average cost of dispute increased over the past few years to US$91 million. The cost in 2016 was US$56 million which was a decline from the cost in 2015, US$82 million.

The increase in value can be due to the number of larger projects that are being established within the region which would result in higher dispute levels.

However, the length of time it takes to resolve disputes have continued to decline from previous years. In 2015 the time it took to resolve a dispute was 15.2 months, which dropped in 2016 to 13.7 months and now has declined slightly more to 12.5 months in 2017.

The Number 1 dispute cause in this region is failure to make interim awards or extension of time and compensation. This cause is new in 2017 for this region. The method to resolve these disputed remains the same – Party-to-Party Negotiations.

Key Takeaways from the Global Construction Disputes 2018 Report:

• The team handled the same amount of construction disputes in 2017 compared with 2016 and expects this to stay the same for 2018.

• Where a dispute involved a Joint Venture (JV), the dispute was between the JV partners or driven by a JV-related difference 35.7% of the time (32.24% in 2016).

• For 60.5% of cases, project participant conduct was very often found to be at the heart of the dispute’s outcome (34.8% in 2016).

• Contract and specification reviews were considered the most effective claims avoidance technique.

• Owner/contractor willingness to compromise was the most important factor in the mitigation/ early resolution of disputes encountered.

—

For more details and solutions to the issues/disputes noted above, read the full report here – Global Construction Disputes 2018 Report – Does the Construction Industry Learn from Its Mistakes?

What are your thoughts on these findings? Leave a comment below and let us know.